Amidst the furore of the January transfer window, the UEFA European Club Footballing Landscape report was published, a report which UEFA assert is ‘like no other publication of its kind’. In terms of scope and depth though, it supersedes the analysis of the oft-quoted Deloitte Money League, which I broke down with respect to Liverpool FC here. That being said, I would recommend you read that first, as an introductory piece, to provide some context to the following discussion.

For this article, we’ll be very briefly looking at the key findings published for football clubs in general, then how Liverpool fare within this context and compare to its domestic rivals, before highlighting areas for improvement or concern. I hope to make this a reference point for future discussions, so I will be looking to include as many figures, tables and discussion points as possible, as a result, this may be a piece you might have to bookmark and make your way through over time.

Key Findings

At a fundamental level, across Europe, clubs are increasing their revenues, their value and investment within themselves. This is in line with the trend established in recent years, with the commercial-side aspect of football clubs more important than ever before, for example:

”Clubs’ ability to leverage their brands is the single most important differentiating factor between the top dozen clubs and the rest. Looking back across the last two business cycles (2010 to 2016), the 12 largest and most global clubs have generated an extraordinary €1.53bn increase in income from their sponsorship deals and commercial activities. This compares with increases of just €700m for the rest of Europe’s top-division clubs combined.

‘Despite wages growing at the fastest rate since 2010, clubs reported the highest operating profits (before transfers) in history of more than €800m in 2016.’*

These trends are remarkable, with growth both rapid but seemingly stable – provided the commercial-side believes their investments are worthwhile. With respect to the report in general:

‘…the positive revenue, investment and profitability trends identified in last year’s report are continuing. The underlying health of European club football is highlighted, with the 700 top-division clubs together generating the highest operating profits before transfers in history and year-on-year revenue growth of almost 10%. Clubs are generating revenue but they are also investing in assets and infrastructure…’ – Alexander Čeferin, UEFA President*

It seems to be rosy viewing for European clubs, but the European leagues have been dominant for years, and the top five leagues all have “super-clubs” and perhaps even “hyper-clubs” who are simply in a different financial class to the rest of the pack. Where then do Liverpool fit in, and is there a hope of permanently securing the “super-club” status, or even pushing onto “hyper-club” levels?

These are questions which cannot be answered by looking at Liverpool or Liverpool and its rivals, or even Liverpool, its rivals and recent financial reports because a great deal of this is relative – should City and United spend at their current rate, there’s little Liverpool can do to compete, however, we shall avoid hypotheticals, and instead will try to make an informed prediction of where Liverpool FC might find itself in the coming years, bearing in mind the trend rate of growth and progress.

Liverpool’s economic performance

There are a number of points within UEFA’s analysis, and we’ll follow their structure within our – club specific – breakdown. However, we’ll largely be skimming over a number of categories, such as “Ownership” and “Agents”, for the first deals with ownership patterns, i.e. the number of domestic vs. foreign owners, and the “Agents” category focusses on rising fees, and points such as these do not provide any specific insight to Liverpool FC.

Domestic competitions and supporters

The globalisation and commercialisation of football are often referred to in present terms, such as “the growing commercialisation of football has led to new sponsorship deals”, for example. Statements, such as these, are simply not true. Football has already globalised and commercialised. These phenomena are now undergoing a period of advancement, but they are deeply entrenched within every major club, and clubs have recognised this, with efforts to maximise their outreach and commercial presence.

Supporters are still important, with their presence a huge contributor to revenues; matchday revenues comprise 19pc of all of LFC’s revenues, and the expansion of Anfield, something which we’ll refer to a number of times throughout this piece, is central to sustaining competitive figures, relative to Liverpool’s rivals.

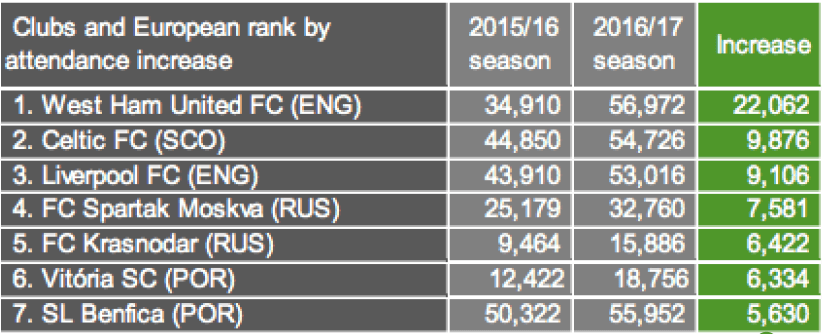

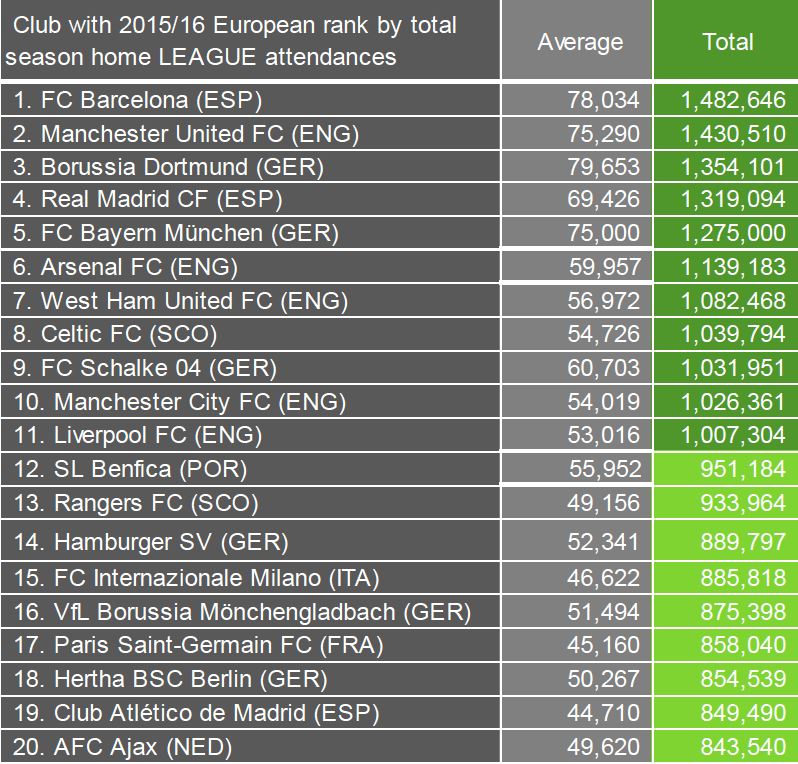

‘For the first time in European football, 11 clubs have reported aggregate league attendances of over a million. New in this category since last year are West Ham United FC, Celtic FC and Liverpool FC.’ p.14.

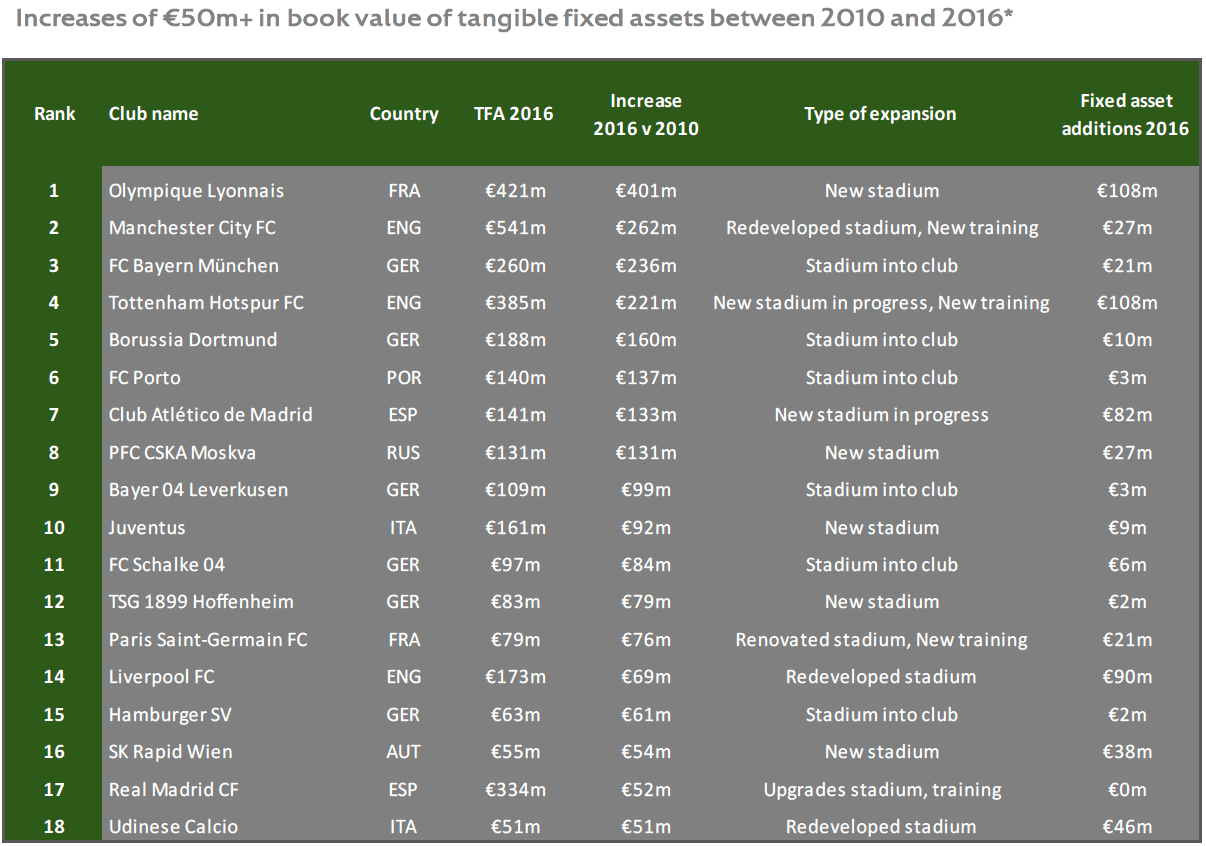

‘Underlying revenue from gate receipts increased by 7% in FY2016, the fastest rate for a number of years. Various stadium developments (Liverpool, Lyon, Manchester City and West Ham) combined with large capacity clubs hosting more home matches (Borussia Dortmund, FC Barcelona, FC Bayern and Manchester United FC) explain this trend.’ p.63.

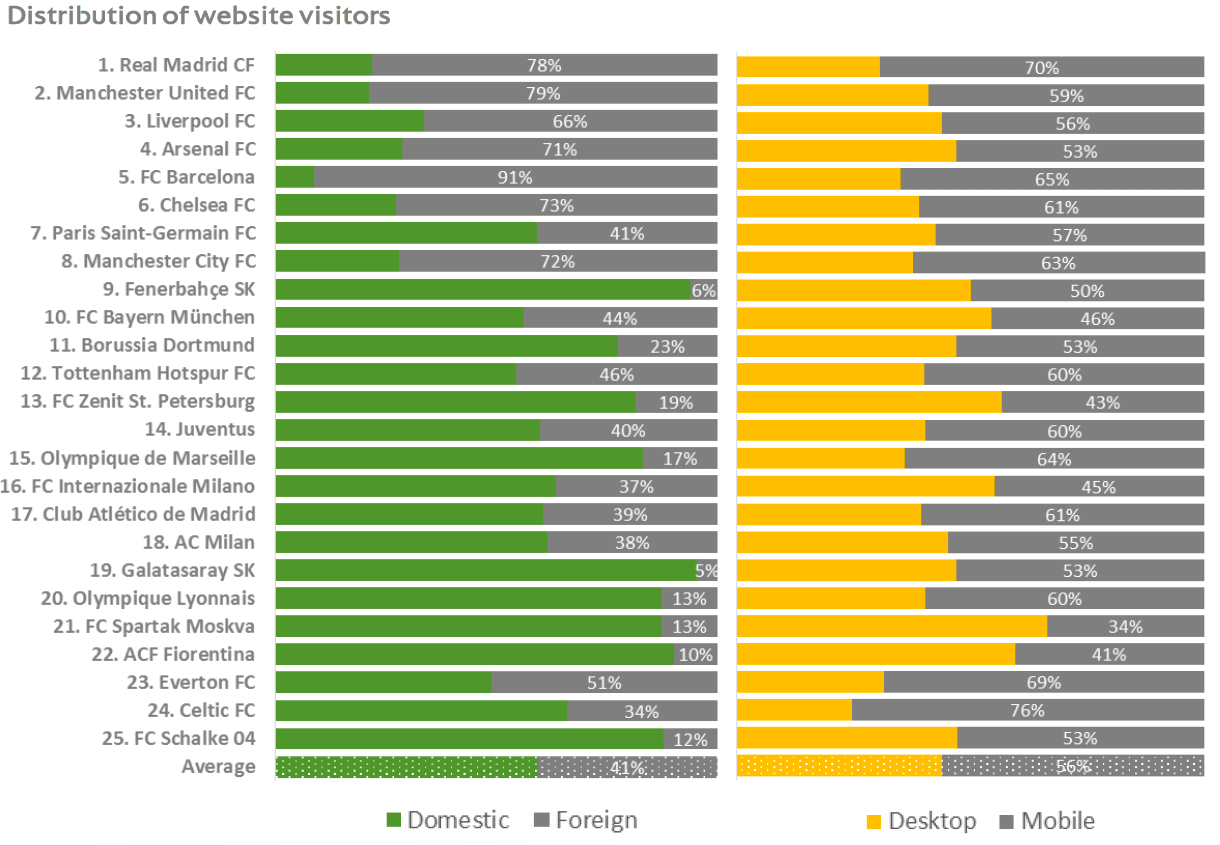

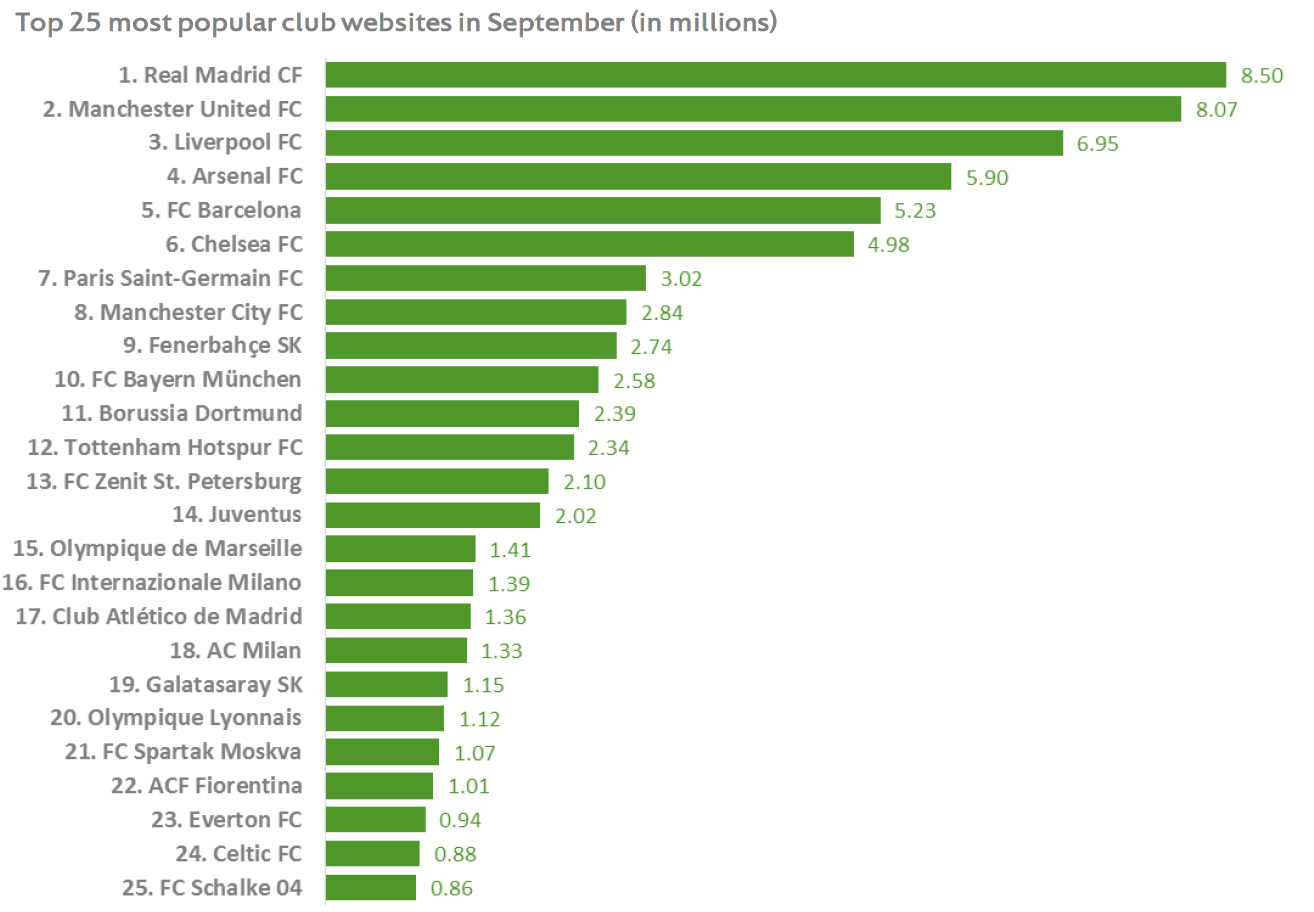

This globalisation of football referenced above is illustrated well through the graphic below, with 66pc of visitors to the LFC official website from outside of the UK – however, there is still clear scope to improve, and targetting the Far Eastern – particularly Chinese – markets, alongside the USA – through the American ownership connection – should be two objectives for Liverpool – and recent pre-seasons seem to show an active interest by the club to target these two regions in particular. Simply put, Liverpool FC needs more fans from outside of the UK, to seize advantage of the additional revenue they can bring to the club.

Sponsorship

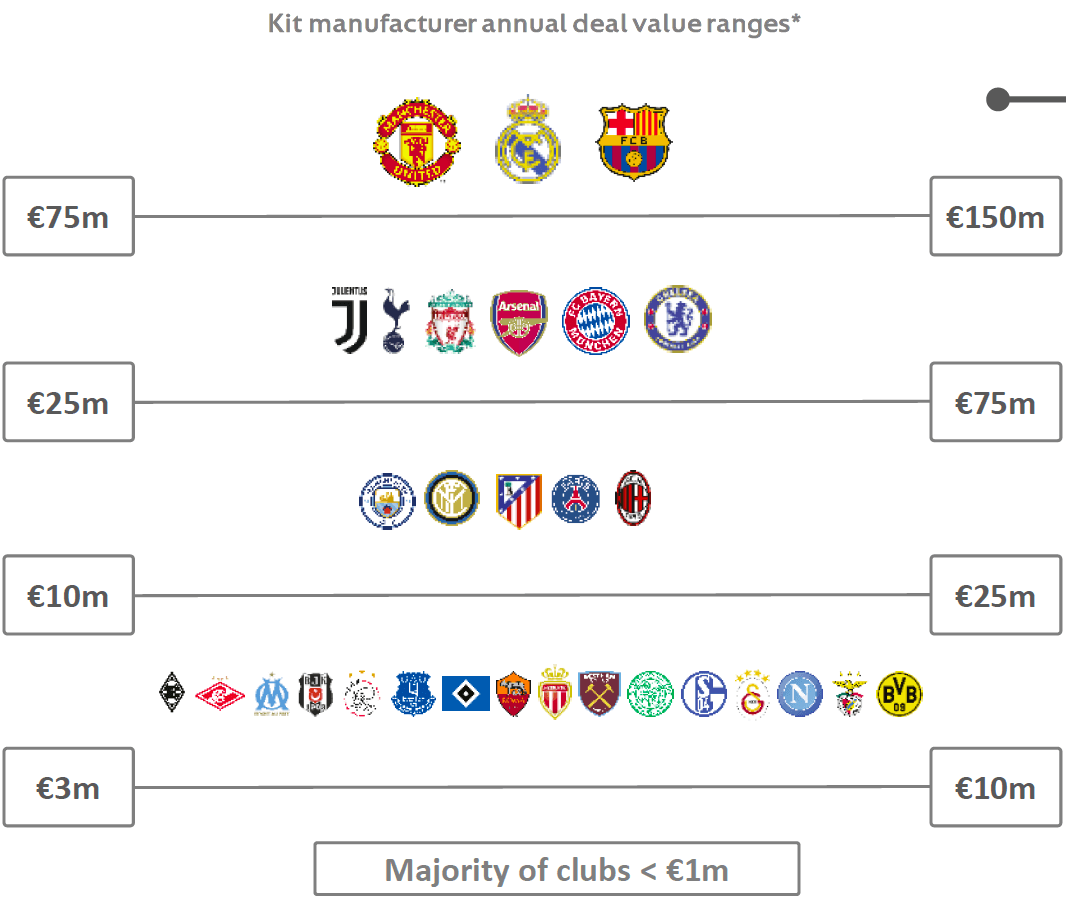

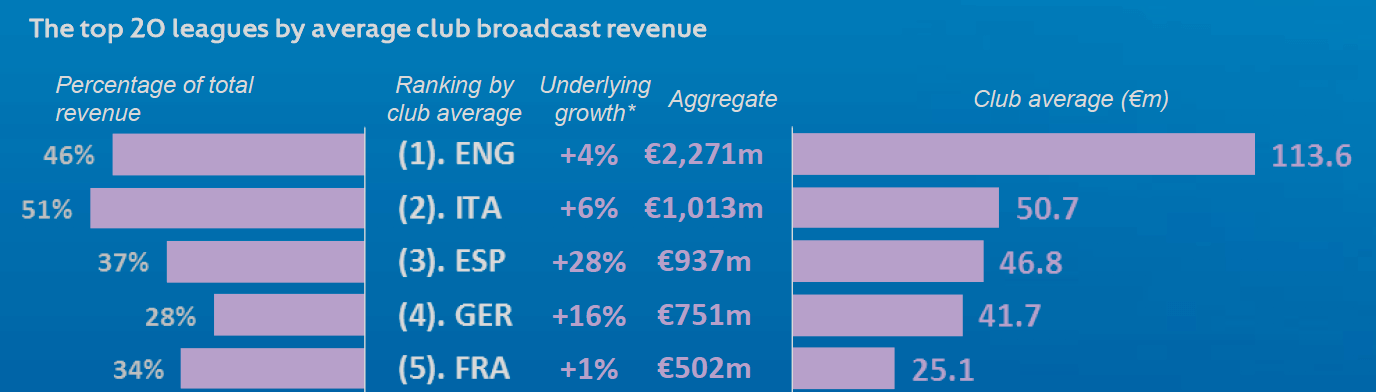

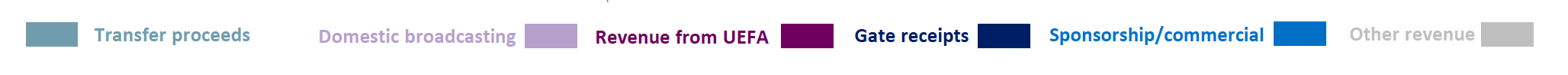

Sponsorships form the commercial backbone to revenues, but there’s a clear distinction between the “hyper-clubs” and their deals compared to the “superclubs”, and this is visible in the graphic below; both the manufacturer and shirt sponsorship packages for United, Real Madrid and Barcelona are considerably superior to the chasing pack.

However, there is some scope for Liverpool to really gain some ground, and steal a run on their domestic competitors: Liverpool’s kit manufacturer and shirt sponsorship deals both are up for renewal in three years, compared to United, Chelsea and Spurs who have seven or more years left with their manufacturer, and Arsenal, Chelsea, Spurs, United and City who have five, seven and ten years left on their respective sponsorship deals.

Longer deals usually pay better – with United’s £750m Adidas deal spread over 10 years, but the cost to this is the possibility of readjusting those benefits relative to the market, for if the inflation on payout for these deals is relative to revenue growth, for example, teams with long-term packages could fall behind their rivals.

It’s not easy for a club like Liverpool to suddenly secure a world-record deal though, and often these deals are pegged to performances too: with Manchester United only guaranteed £75 million per year provided they meet certain criteria, one of which is Champions League qualification.

What we’ve also seen a rise in too are shirt-sleeve sponsors, and this is a phenomenon which is sure to stay, as it’s a growing trend in the top leagues: 17 teams in the Bundesliga, Ligue 1 and the Premier League currently have sleeve-sponsors, whilst 13 do in Spain. What seems to be next in line though, are stadium naming rights: 14 stadia in Germany and 8 in England have sponsored titles, and this very much seems the way to go.

‘The top 12 ‘global’ clubs generated commercial and sponsorship revenue of €940m in 2010 (25% of the €3.8bn total for all European top-division clubs).

‘Our analysis suggests that the polarisation of commercial and sponsor revenues between the top tier of clubs and the rest is set to continue. Only the largest clubs have the scope to take full advantage of the increasing international media profiles of the top leagues. Significant operational resources are needed to set up and service commercial partnerships across the globe and global sponsors are attracted only to the top football ‘brands’.’ p.76.

Liverpool already have a global brand, and are tapping into it, but the club has a long way to go in order to compete with Barcelona or United: using individual players though, such as Sadio Mané, or Mohamed Salah – both leading players within their national sides – to spearhead their commercial strategy may be a useful ploy to consider though.

Transfers

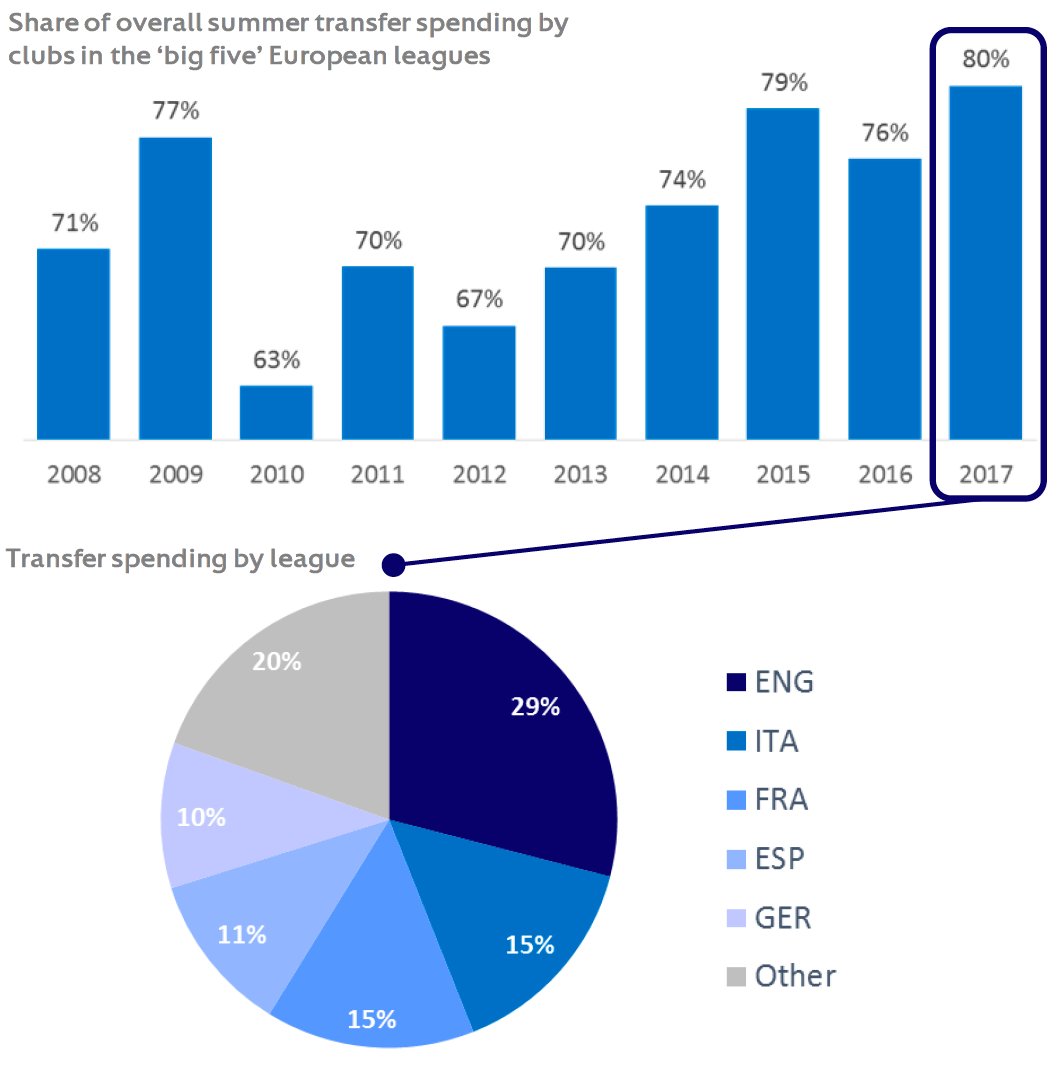

With regard to LFC’s transfer dealings, the report did not disclose a great deal of club-specific detail; FY2016 was one in which Liverpool spent relatively little too, but what we can assess are the trends, and how these may impact on Liverpool.

Transfer fees and agent fees have been going up, and that’s plainly obvious. What is not obvious yet is the limits of this inflation – at which point will clubs within the Top 20 of Deloitte’s Money League begin to be priced out of all top-tier transfer deals, or will this even happen?

The trend seems to keep rising, and there’s a disproportionate concentration of high fees within the English league. Revenues may be increasing within the Premier League due to broadcasting and sponsorship deals, but if these revenues are largely being spent on transfers, clubs will begin to encounter financial troubles on the occasions they don’t generate the necessary revenue from sponsorship/broadcasting deals due to dropping out of a competition or underperforming, which will impinge on performance related payouts. From here it’s easy to see how clubs may struggle if they cannot attract the players they need to achieve the “necessary” performance-based payouts because the answer will either be to spend more money or to change the management – two approaches which are not sustainable in the long-run.

We can’t predict for certain how this will shape up, but transfer fee inflation seems to be ever-increasing, and is not showing signs of slowing down – yet. At the point transfer fees do start to plateau, Liverpool fans will have to hope they’re still economically competitive, or risk being priced out of the top end of the market altogether. To some extent this is already in place – with transfers of over £100m including a select few clubs, but clubs such as Arsenal, Liverpool, and Chelsea do still have the ability, at the moment to spend sums of that size – whether they will be able to do so in future will depend on the market and the clubs’ economic performances.

Club revenues

Over the past 20 years, European clubs, on average have enjoyed 9.8pc annual revenue growth, with the average revenue triple what they were in the year 2000.

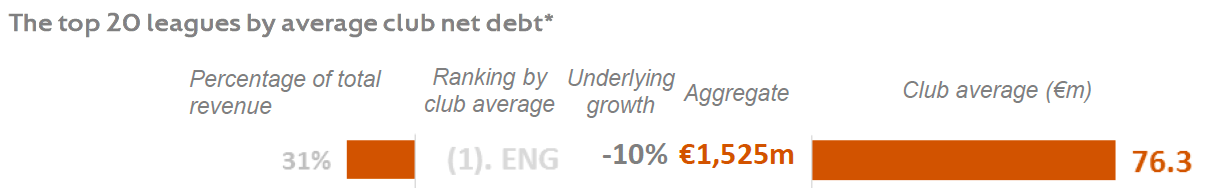

Within England, the average revenue growth since 2010 has been 82pc for clubs – by far the biggest growth of any of the European leagues; only the German and Spanish leagues are genuinely comparable with 64pc and 54pc respective growth on average.

![]()

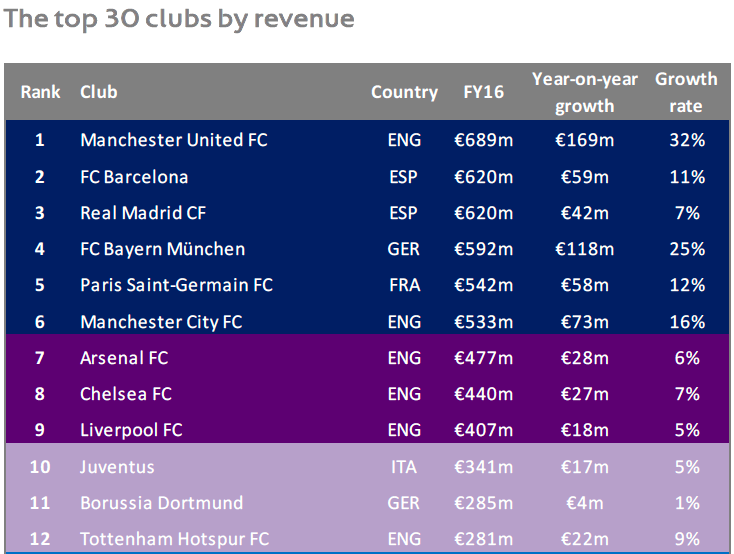

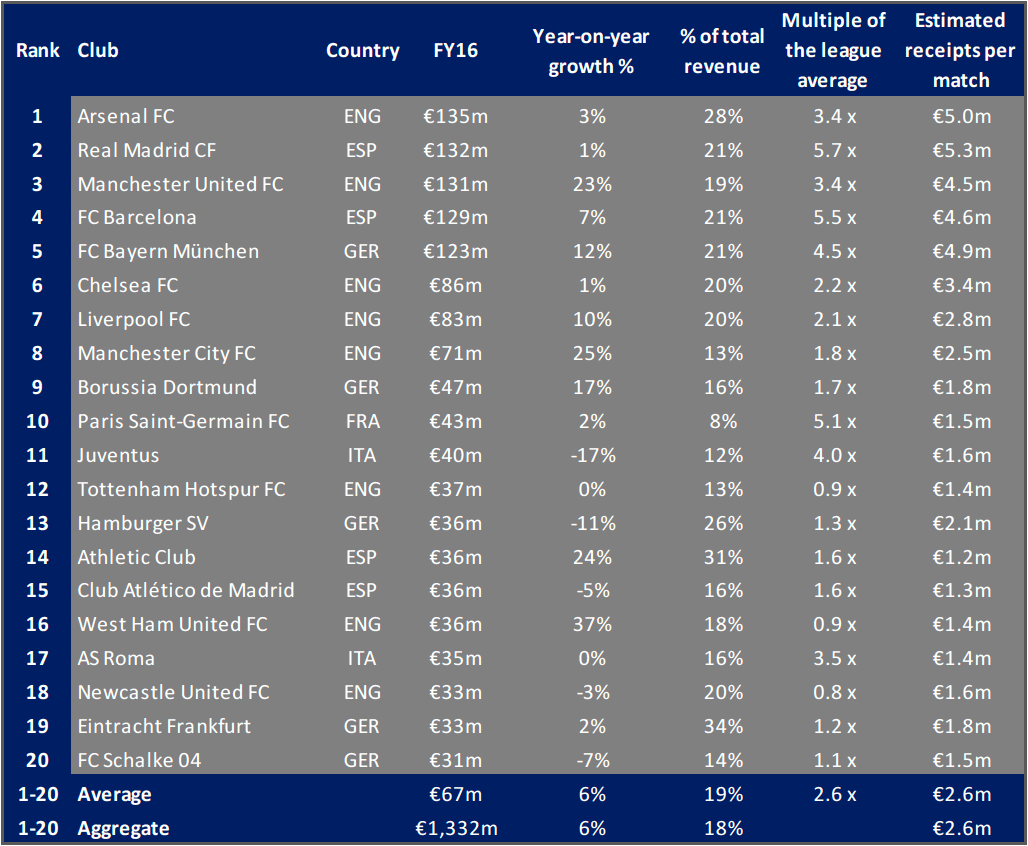

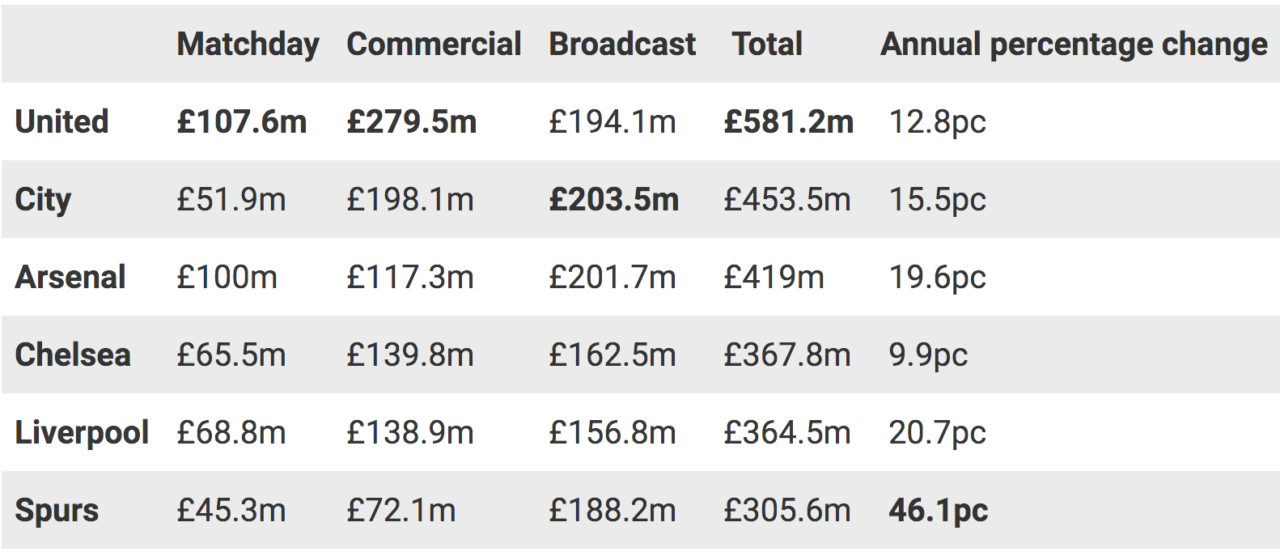

To introduce some context to which we can judge Liverpool by, I’ll be quoting my earlier piece reporting on the Deloitte Money League – which focusses on revenues:

‘With £364.5m generated in revenue, Liverpool had a 20.7pc increase on total revenues compared to last year, a considerable amount, and reflective of both the Premier League economic climate, but also the commercial work the club has done over the past few years.’

Additionally, the following quote is from another financially-related piece of mine from Summer 2017:

‘Liverpool in comparison [to its rivals] are only one spot behind Chelsea, at ninth globally. Total revenues only amount to 302m GBP, 19pc of which is from matchdays (£56.8m), 42pc from broadcasting (£125.7m) and 39pc from commercial deals (£119.5m)

Liverpool’s matchday revenues outstrip Manchester City’s, but are below all other competitors, stressing the need to expand Anfield. Liverpool struggled in terms of broadcasting rights, but these figures were calculated following Liverpool’s first season under Klopp, and broadcasting revenues are expected to be lower considering Liverpool were not in the Champions League. In terms of commercial deals, Liverpool are in a stronger position than both Arsenal and Chelsea, but when it comes to overall revenues we must account for the historical context.

In 2012, Manchester United’s revenues stood at €396m, now they stand at €689: a percentage increase of 73.9pc. Likewise Manchester City’s revenue growth from €286m in 2012 to €525 in 2016 is a phenomenal increase of 83.6pc. Arsenal’s growth from €290 to €469 amounts to a 61.7pc rise. Whilst Chelsea’s €323 to €447 is the smallest of any of the Deloitte Top 10 English teams, at 38.4pc.

Comparatively, Liverpool’s €233 in 2012 to €404 in 2016 was an increase of 73.4pc, beaten only by the two Manchester clubs, both of whom have financial and structural resources far greater than those of Liverpool FC.’

Television

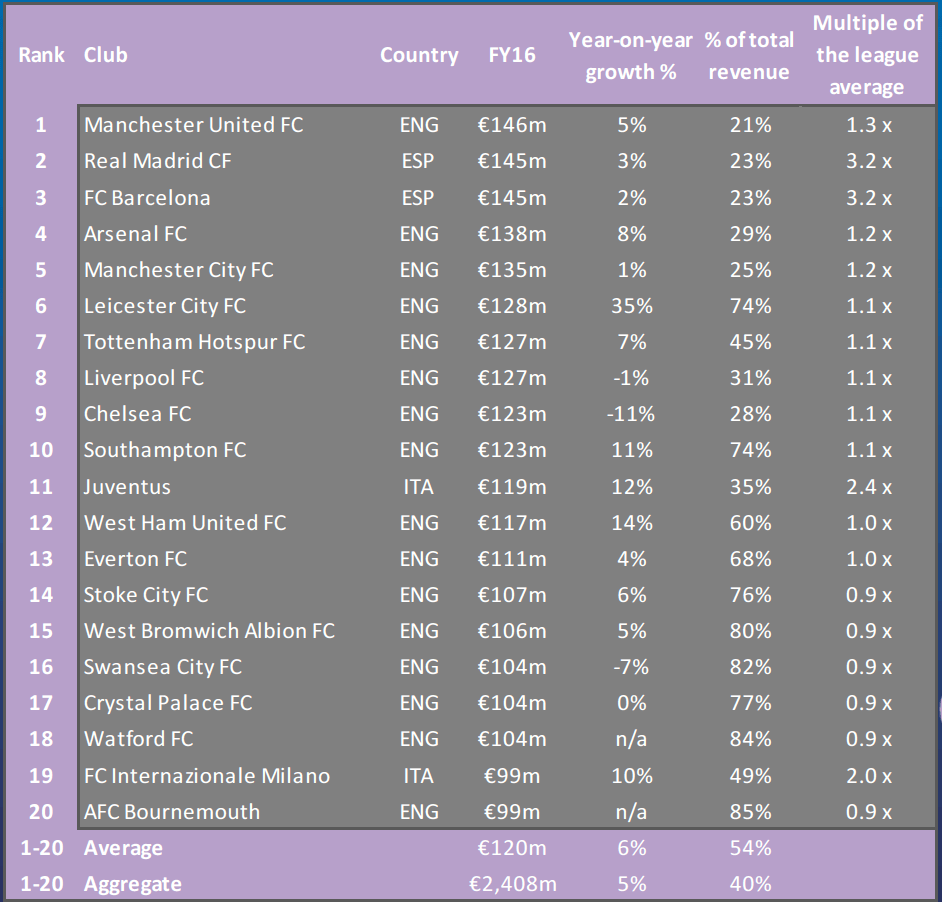

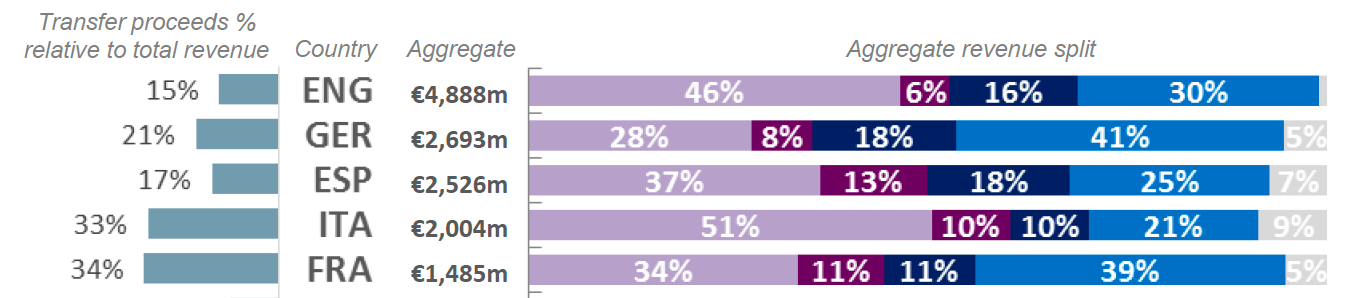

Broadcasting Revenues:

Of the top 5 leagues, on average, English clubs fare best in terms of television revenue; however, English clubs are treated the second fairest in Europe with regard to how these revenues are spread across clubs – with clubs ranked ‘high’ to ‘median’ given a 1.3 multiplier, whereas in Germany the clubs within the same ranking would earn 2.3 times the league average; French teams within the same bracket would have a 2.4, 3.3x for Italian sides, and 4.1x for Spanish sides.

In terms of fairness, the Premier League is making considerable headway, but Liverpool and other top clubs should push for a greater proportion of the money, and assert their case that viewing figures are dependent upon them, rather than the lower clubs within the league.

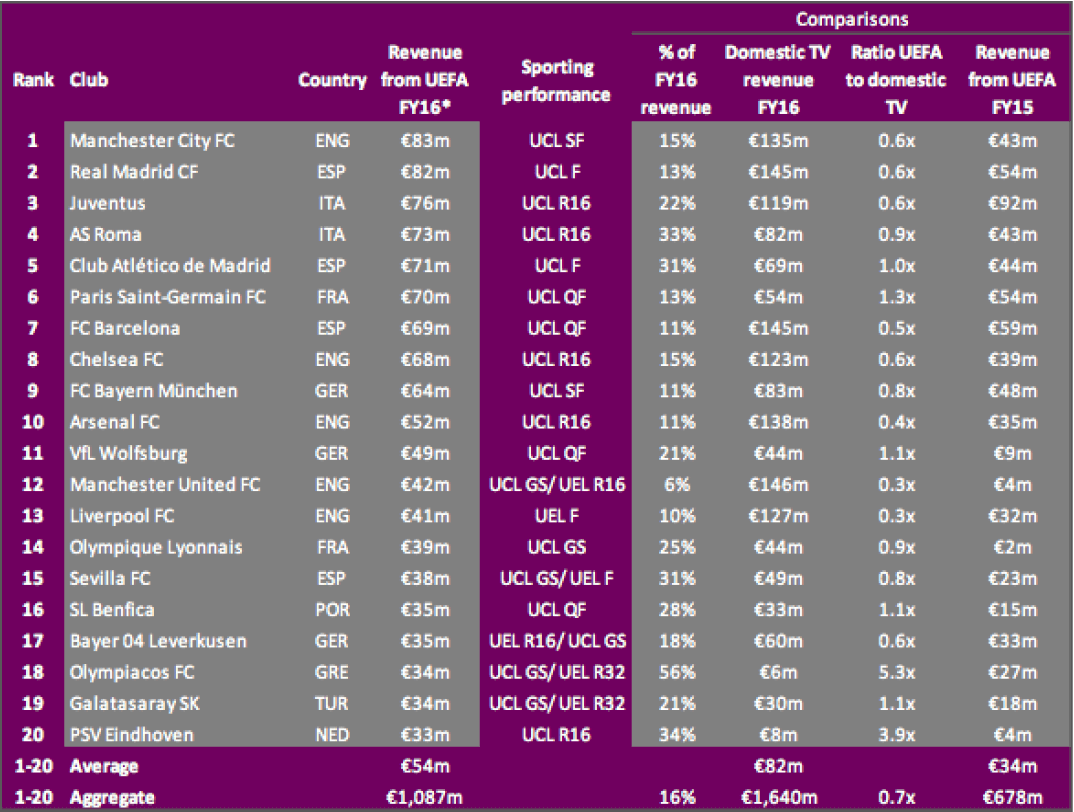

One key factor mentioned earlier is the effect of Champions League or Europa League qualification: Liverpool managed to sustain revenues rather well whilst out of the Champions League, but for the top English sides, participation within UEFA competitions contributes to 10pc of broadcasting revenues, meaning Liverpool really cannot afford to miss out on Champions League, especially as rivals will profit at Liverpool’s expense because of it.

‘The €41m received by Liverpool FC for featuring solely in the Europa League is only €1m less than Manchester United FC, who started in the Champions League group stage before dropping down into the Europa League. This underlines how qualifying for the Europa League is of significant commercial interest for clubs.’ p.69.

Matchday

‘The redevelopment of the Main Stand at Anfield by most accounts has been successful, and with increased matchday revenues of £68.8m, up £10m (17pc) from last year, it would seem the next logical step would be to increase capacity, perhaps in the Anfield Road end, in order for the club to compete with United, City and Arsenal, who all have stadiums with a capacity of 60,000 or more, as will Chelsea and Spurs, once their respective stadia redevelopments are complete.’ – Liverpool: Deloitte Money League Report

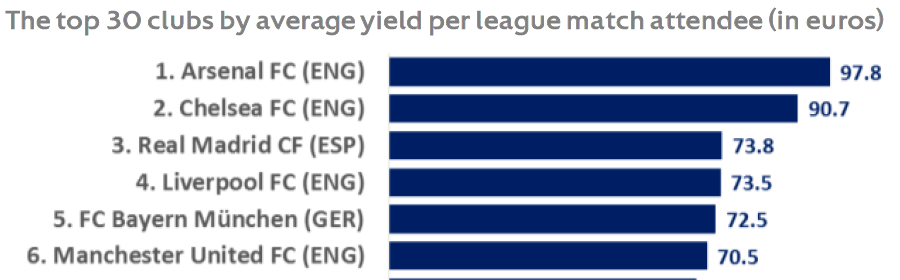

Important to Matchday revenues though is the yield per person attending, i.e. the surplus money spent by consumers, on food, drinks, merchandise etc.; LFC’s yield per spectator is high, however, the club just need to utilise this impressive yield rate in line with, or beyond the stadium expansion.

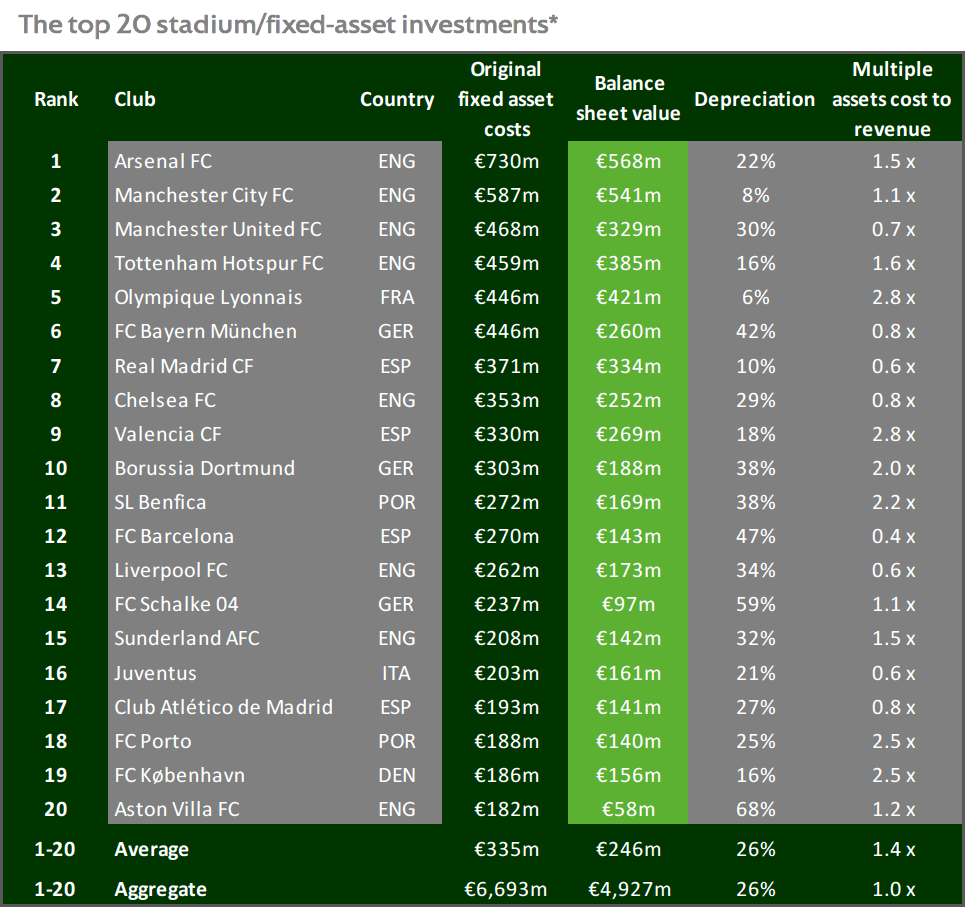

‘The average yield underlines the positive impact stadium development can have on increasing the revenues of a club and on diversifying their revenue streams. The average yield (in euros per attendee) reflects the blend of normal and premium pricing. New stadiums can drive high yields as evidenced by a number of the top ten clubs by yield (Arsenal FC, FC Bayern München, [etc.]…), who have moved to new, modern stadiums in recent years. Other clubs near the top of the list have benefitted from major stadium upgrades (Liverpool FC) or regular upgrading of facilities (Real Madrid CF) that have lifted numbers and yield from premium ticketing.’ p.71.

‘Most of the clubs in the top 20 operate at or near to full capacity and this limits their potential for year-on-year growth to price increases. However, after growth of just 1% in FY2014, there was a significant 6% increase in FY2015 boosted by a large recovery in Galatasaray SK attendances and higher gate receipts at Liverpool FC, partly as a result of them playing more cup matches.’ p72.

Gate receipts, as illustrated below, is an area in which Liverpool can really look to expand and capitalise on: a large proportion of Arsenal’s revenues comes from that particular stream, and cup runs, as noted above, also contribute to it too, so through mere virtue of being in the Champions League, this figure should rise alongside the broadcasting and commercial revenues too, and here we can begin to see just how important the Champions League is, aside from the revenue directly attributed to UEFA, above.

Wage and squad costs

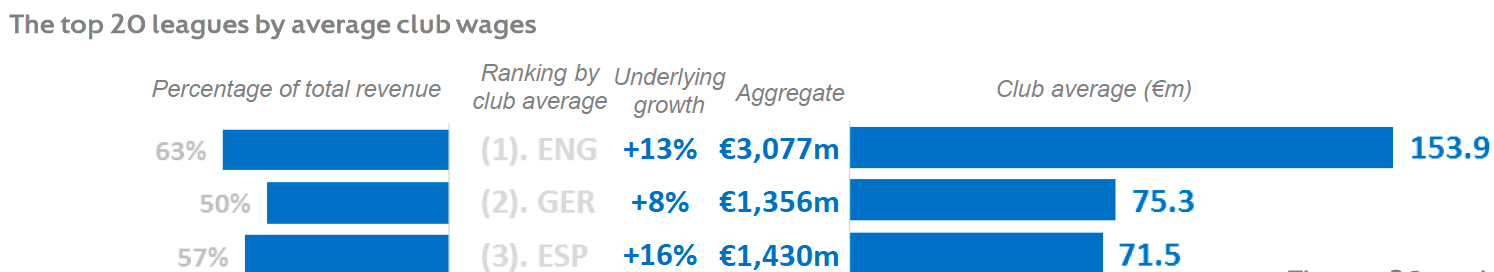

‘Wage growth has increased to 8.6% but remains below the 9.5% club revenue growth.

‘For the first time on record, the average wage bill (€153.9m) of the highest-paying league (English Premier League) was more than double that of the next highest-paying league (Germany’s Bundesliga, €75.3m).’ p.81

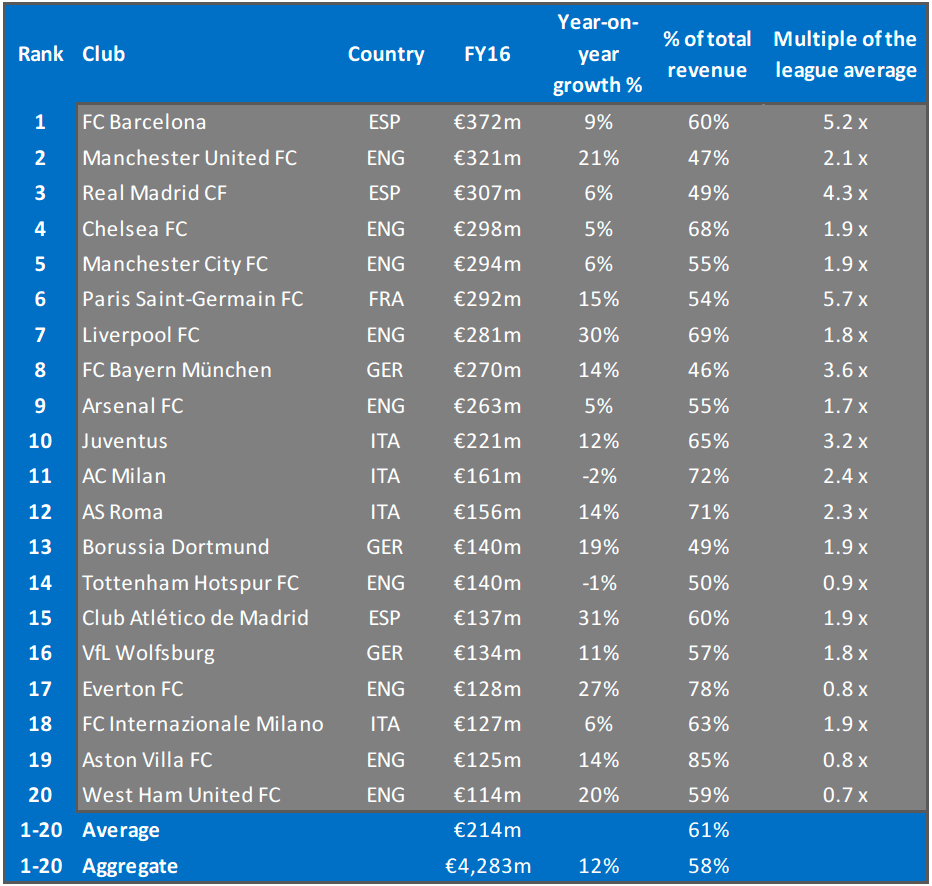

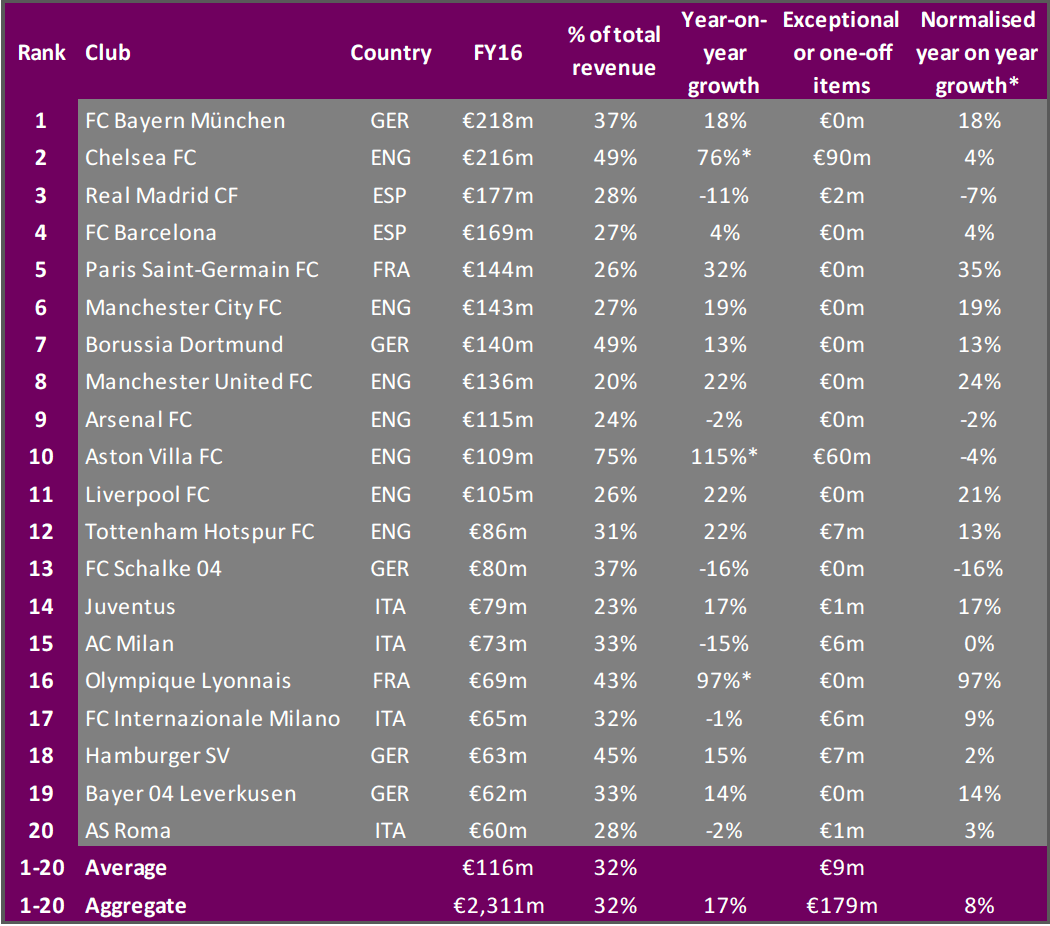

Wages, like transfer fees, are rising at an impressive rate, however, they’re rarely discussed as much as transfer fees. As the quote above shows, clubs, in general, are broadly coping well with rising wage costs, due to increased revenues across the board, however, Liverpool, in particular, have a wage bill that is far too great to sustain or add to.

A staggering 69pc of all revenues are taken up by wages, United, in comparison have 47pc of their total revenues directed towards wage costs. Of the top four highest revenue clubs, on average they spend 58pc of revenues on wages, and of the clubs ranked 5th-8th, they spend on average 62pc, meaning Liverpool are above the trend – that being said, Champions League involvement may go someway to offset such a large proportion of total revenues being spent on wages, but there is a simple problem that needs to be solved: Liverpool must either reduce their wage costs, and thus cut some players from their squads, or the club has to increase revenues – if the club does not act, this could seriously impinge on the club’s ability to invest in other areas of the club, and hinder long-run growth.

This is not an issue of general, non-footballing employees within LFC, as on average, 73pc of total wages are spent on players themselves, but as we know, the squad is thin at the moment and will require considerable reinforcement if the club wishes to compete on multiple fronts, thus focussing on increasing revenues even more so than at the moment has to be the short and medium-term objective.

‘The number of clubs with wage bills in excess of €100m increased from 24 in FY2015 to 30 in FY2016, with 10 of those clubs exceeding €200m. The average wage increase among the top 20 was 12%, following on from the 14% increase the previous year. The largest percentage increases were at Club Atlético de Madrid (31%), Liverpool FC (30%), Everton FC (27%) and Manchester United FC (21%), with wage inflation anticipating the new Premier League TV increases. Of the 20 highest-paying clubs, only four recorded a wage bill of more than 70% of total revenue, and 12 clubs recorded a healthy ratio of less than 60%.’ p.86

Operating and transfer costs

‘Historically, much of a club’s operating cost base has been either fixed (assets and property, cost of facilities and basic administrative costs) or linked to the number of matches played (matchday expenses).* With revenues increasing significantly each year, the proportion of revenue dedicated to (non-wage) operating costs therefore decreased markedly from 39% in FY2010 to 33% in FY2014.

‘However, the last two years have seen significant increases in non-wage operating costs, with growth of 10% in FY2016. Part of the increase can be explained by one-off items (impairments and other exceptional costs) and the slight increase in cost inflation, but it appears that operating costs are now increasing as clubs expand their commercial, sponsorship and stadium activities.’ p.95.

The second quote illustrates the growing operating costs for top clubs in Europe, and also the growing necessity for these costs to rise, as clubs attempt to increase their productive capacity. Liverpool’s operating costs are not that high, but we should expect them to rise in future, in line with attempts to increase outreach and exposure.

‘Club operating costs (excluding wages) increased at a record 8% among the top20 clubs in 2016, underlining the significant spending away from the pitch that the top clubs are making to support their global club brands.’ p.91.

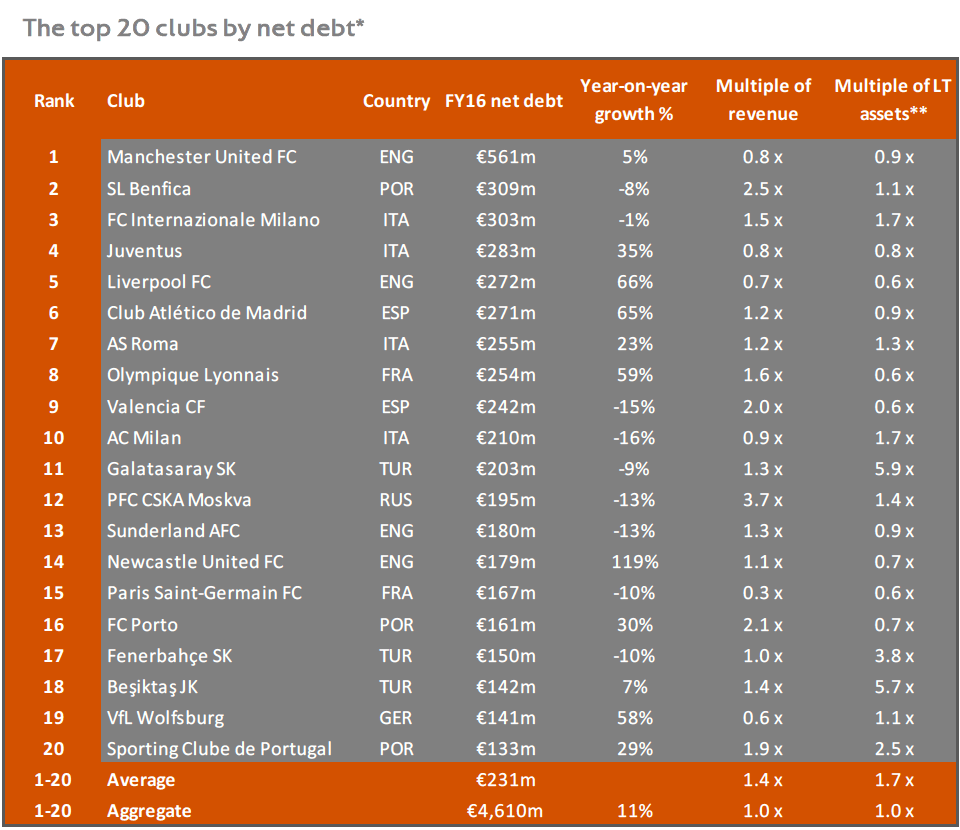

Debt

Debt has been an especially important consideration for LFC’s ownership considering the context in which they bought the club, and also how FFP restricts clubs from taking on debt they cannot afford. But with debt there are other important aspects to take into consideration before coming to a conclusion, two of which are asset value and investment:

What we’re seeing is the club taking on debt, but this debt – crucially – is managed and sustainable debt, which in most cases is borrowed from the ownerships’ fund. On the occasion this debt is not from the ownerships’ fund, it will likely be from banks; considering the extremely low-interest rates – which the Bank of England has set a base rate for – clubs like Liverpool should be looking to seize upon this opportunity to raise funds with relatively low costs.

‘It is important to analyse net debt in context rather than in isolation, as the risk profile of debt to finance investment is clearly very different to debt taken to fund operating activities. The chart and table above include the ratio of net debt to revenue, which is used as a risk indicator for the purposes of financial fair play, and the debt to ‘LT assets’ ratio, which are often used as security against the debt and are often funded or part funded by debt.’ p.122

The growing value of the club’s assets too gives the club the ability to take on greater amounts than they would have previously, in order to invest and increase the capacity and scope of the club – in this regard the ownership and board are making serious headway.

Areas for improvement

As it so happens, I was writing this piece with the intention of highlighting the importance of Liverpool increasing their stadium capacity, and I am delighted to say that a report has emerged detailing the club’s ambition to expand the Anfield Road end of Anfield. This would be not only a fantastic statement of intent, but a measure which would go some way to rebalance the revenue streams and allow Anfield to qualify for the top tier of UEFA stadium ranking – allowing Liverpool to bid to host international or club competitions.

There is cause for concern with regard to the proportion of revenues which are being spent on wages, but Champions League qualification and broadcasting deals should help ease that burden, still, reducing it to the levels of rival sides should be an objective for the club, but one that does not come at the cost, or at least endangers the prospect of Champions League qualification, for sustained qualification will yield higher revenues, and exclude rival English clubs from those revenues. From this platform, the club can go on to invest more and consistently push for titles, but that is an undeniably tough challenge.

Fortunately, the board seems keen to increase revenues and the capacity of the club:

‘Stadium development projects (new builds and upgrades) at Club Atlético de Madrid… Chelsea FC, Liverpool FC… and Tottenham Hotspur FC should lead to additional revenue growth, some movement in the rankings and a potential narrowing of the gap beneath the top five in the years to come.’ p.72

#lfc have submitted a planning application to turn the old retail store in the Kop into a 700 capacity bar, opening 4 hours before kick off (decision in April).

— David Phillips (@lovefutebol) February 12, 2018

As always, there are areas for small improvement, and large improvement too, but there is no foreseeable crisis looming financially. The scope of the challenges for LFC varies considerably, but a lot correlates with on-pitch performances – the club has done a lot of catching-up after only qualifying for the Champions League twice in 10 years, and while United, Barcelona and Real Madrid are well out of the picture for now – catching up to and then eventually overtaking Chelsea and Arsenal should be the objectives for the next 5-10 years or so.

In sum, the club is in solid financial health but is still behind its competitors. The only way to supersede them is through consistent Champions League qualification at their expense, sustained revenue growth, market-leading commercial deals and structural investment to the club, the stadium and its global brand – tapping into foreign markets; making LFC more marketable is the key to this, but this is a multifaceted and constantly evolving market and situation Liverpool FC finds itself in. That being said, despite these challenges, it is pleasing to see that the club is attempting to improve in the right manner with a long-term considered plan in mind. Liverpool may not be at the top of the pecking order -financially – and, in truth, may not find itself there for the foreseeable future, but the club retains enough clout to compete for now, and seems to be heading in a direction which suggests it shall not only continue to do so but instead compete at a higher level in future.

Sources:

Quotes, marked with an asterisk are referenced from the link below:

*’UEFA report shows football’s financial upswing’, UEFA.com

https://www.uefa.com/insideuefa/protecting-the-game/club-licensing-and-financial-fair-play/news/newsid=2529909.html#/

All references with page numbers are with respect to the report below:

The European Club Footballing Landscape:

https://www.uefa.com/MultimediaFiles/Download/OfficialDocument/uefaorg/Clublicensing/02/53/00/22/2530022_DOWNLOAD.pdf

Quotes from the articles below are self-referenced

Liverpool: Deloitte Money League Report, anfieldindex.com

The Seven Year Itch | FSG – A Review, anfieldindex.com